Signal Strength: Strong.

Markets closed out the month, the quarter, and the year on a high note.

December Market Review

The S&P 500 Index returned 3.71%

The Bloomberg Barclays U.S. Aggregate Bond Index returned .14%

Fed Funds Target Range: 0 – 0.25%

For a year that felt like it was never-ending, everything actually moved quicker than anyone would’ve believed possible. As the virus spread throughout the country with inexorable speed, it created radical changes to how we live, work, shop, eat, and relate to each other. Our tremendous human capacity to adapt and move forward was resolutely on display.

While we were all coping in various ways, with varying levels of success, the markets modestly settled for… crushing it. Making history weekly. Rewriting their own rules. Everything can’t go up at the same time? Yes it can. Full market cycles can take years? Tell that to credit spreads, which for most sectors, ended the year roughly where they started, despite being historically wide in March.

What can we expect going forward? Clearly the pandemic has accelerated the acceptance of technologies that have been around for a while, like contactless payments, but weren’t seeing broad uptake. There’s a school of thought that suggests there is a “Productivity J-Curve.” New technologies create a dip of productivity when they are first introduced into an economy, and once they are assimilated, productivity rockets upward.

The World Economic Forum reports that more than 80% of global firms it surveyed in October plan to accelerate the digitization of business process and grow remote work, which would seem to indicate that companies are through the investment stage of new technologies and are well into deployment.

In equity markets, the final week of the year saw the S&P 500 up more than 16% for 2020, but if you take it from the March low, the index increased about 65%. The bull market lasted out the year with nine months of solid gains. The Nasdaq Composite index gained nearly 44%. Globally, the MSCI World Index was at a record high on a 14% increase in 2020.

Concentration was the name of the game for the S&P 500 in 2020, with Apple, Amazon and Microsoft generating 53% of the index’s total return. In 2019, trading volume on average was 7 billion shares a day across U.S. exchanges. In 2020, a typical day has seen 10.8 billion shares trade.

Corporate bonds beat out every other credit sector, turning in a 9% total return for 2020. Similarly, the Global Aggregate Bond Index, which includes governments, corporates, mortgages and asset-backed securities, returned 7%. Both investment grade and high yield bond issuance was at record highs in 2020 as, backstopped by the Federal Reserve, companies turned to capital markets for financing needed to ride out the crisis. Investor demand remained high throughout the year, despite low yields.

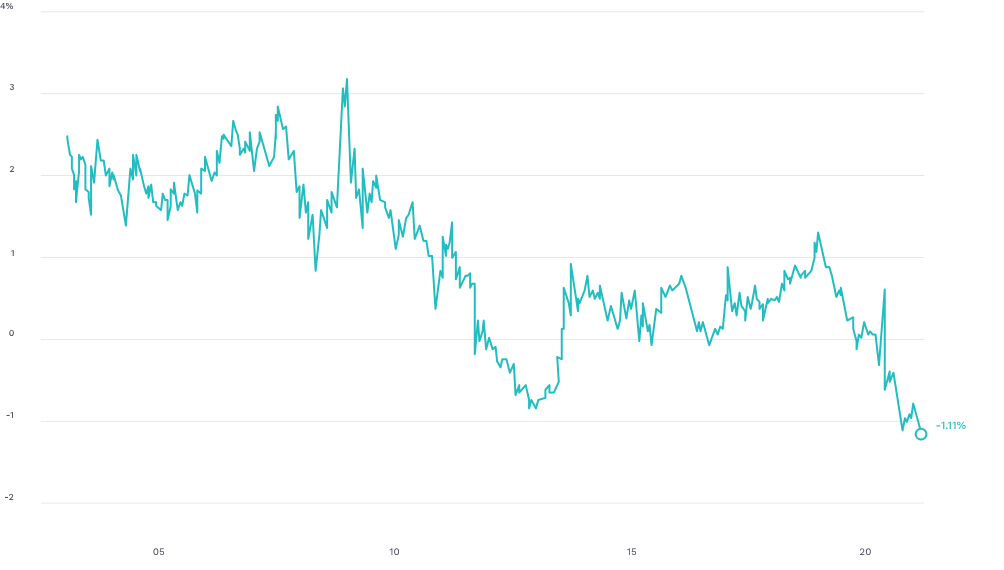

The U.S. leveraged loan market experienced a fourth-quarter recovery with year-to-date returns of 2.79% at the Dec. 16th close, up from year-to-date losses of 20.07% on March 23. High yield corporates also finished the year extremely strong, posting positive returns for seven consecutive weeks and 11 of the last 12. In private credit, the story is about reduced defaults. According to Proskauer, a law firm that tracks private debt loans in the US, the default rate for Q3 was 4.2%, down from 8.1% in Q2 and lower even than the 5.9% rate in the first three months of the year.