Back to the Future?

Signal Definer: Reversed. Both equity and bond markets struggled to adjust to “forceful and rapid” Fed rates language.

Back to the Future?

Signal Definer: Reversed. Both equity and bond markets struggled to adjust to “forceful and rapid” Fed rates language.

The S&P 500 Index returned -4.2%

The Bloomberg U.S. Aggregate Bond Index returned -2.82%

Fed Funds Target Range: 2.25% – 2.50%

The Fed effectively cut short the July – August bear market rally with some very pointed language at the Jackson Hole Symposium. Fed Chairman Powell emphasized that he wants to avoid 1970s-style entrenched inflation that could result from prematurely ratcheting down rate increases. While inflation is trending down, last summer’s inflation declines were followed by increases in the fall and winter.

The data over the month and into the early days of September was largely positive, which underpins the Fed’s position that more rate increases are needed.

CPI Is Still Slowing – Barely

The Bureau of Labor Statistics reported on September 13th that the Consumer Price Index (CPI) increased 0.1% for the month of August, seasonally adjusted. CPI rose 8.3% over the last 12 months, not seasonally adjusted. This is a slight decline from the 8.5% increase in July.

Even with negative performance in August, several equity market indices are above the mid-June bottom. The Dow and S&P are 6.3% and 8.7%, respectively, above their lows. The Nasdaq is 11.8% above its low.

The 10-year U.S. Treasury ended the month at 3.20%, up from 2.66% in July. The 30-year U.S. Treasury ended August at 3.02%, up six basis points. The Bloomberg U.S. Aggregate Bond Index monthly return was back in the red in August as yields increased. The year-to-date return at month end was -10.75%.

The U.S. high yield market declined 2.39% in August, bringing the YTD return to -11.03%, as measured by the ICE BofA US High Yield Constrained Index. Energy and other commodities, capital goods, and leisure were the best performing sectors. Defaults are currently below historical averages.

Leveraged loans bucked the overall trend of credit sectors in August, rallying strongly early in the month and ending up with a positive return of 1.54%. Combined with July’s positive return, this marks the strongest two-month period since May and June 2020. The S&P/LSTA index is down only (1.01%) year-to-date, compared to the return of the overall fixed income market, as measured by the Bloomberg Barclays U.S. Aggregate Index.

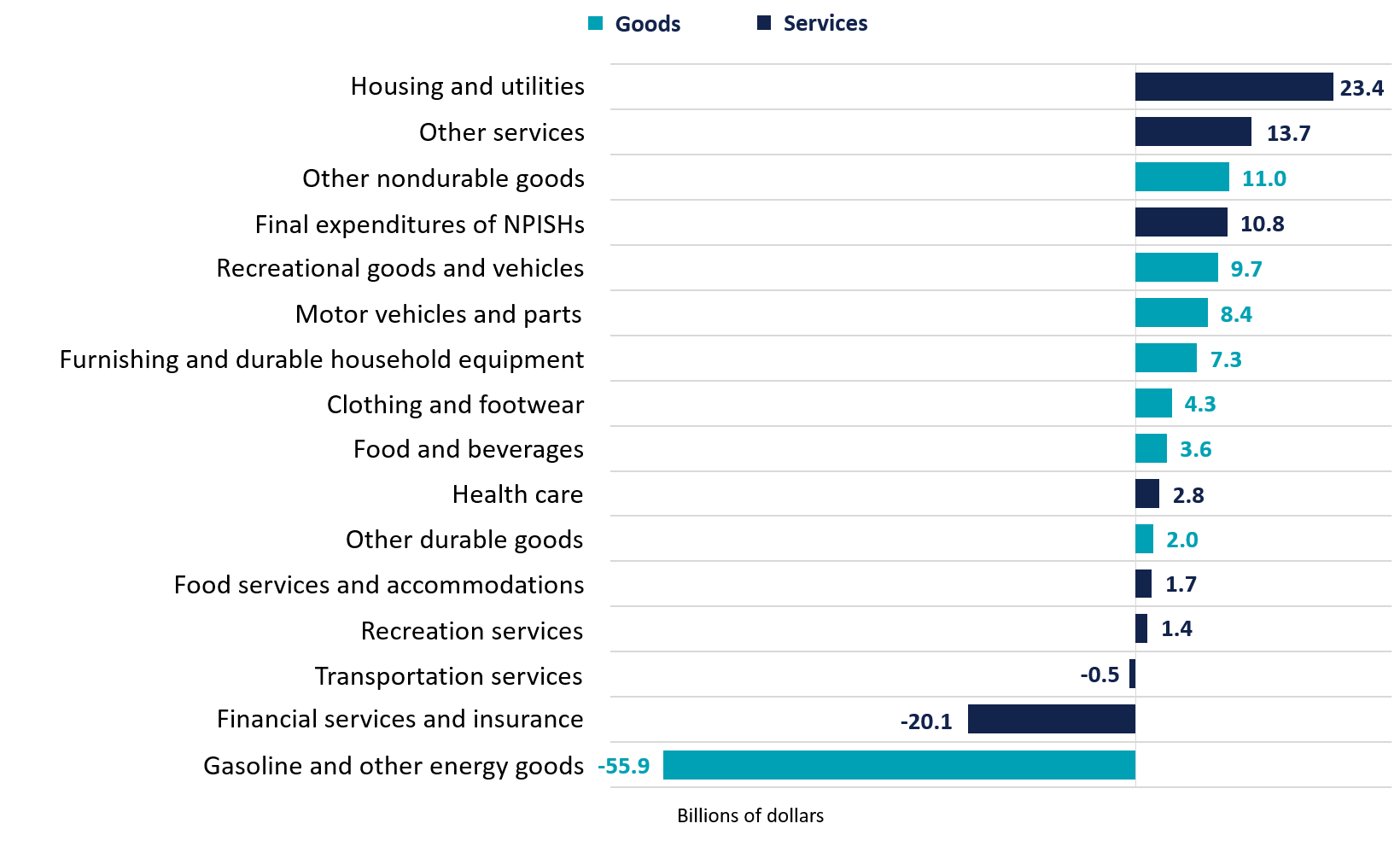

Consumer spending increased by $23.7 billion in July, as falling gas prices only partially offset increased spending in other areas.

July is the most recent data available.

Source: Bureau of Economic Analysis

Source: Business of Apps, CNBC, PetKeen

Introducing New Tech Into Your Practice, and Your Clients' Lives

Read More >>Sign-up for The Signal, a monthly rundown of what moves took place in the credit market and our latest educational and thought leadership content.

CION will use the information you provide to be in touch with you and provide updates. Feel free to change your mind at any time by clicking the unsubscribe link the email you receive. We will never share your information and will treat it with respect.